This project explores the causal relationship between economic shocks and political behaviour by leveraging firm-level and employee-level administrative data from Italy. Motivated by the VALPOP project and recent debates on the political consequences of globalization and structural transformation, it focuses on the effect of plant closures on the diffusion of populist narratives and voting patterns in affected localities.

The empirical strategy relies on a series of natural experiments based on unexpected plant shutdowns. These closures generate exogenous variation in labour market outcomes—such as layoffs, contract termination, wage losses, and re-employment trajectories—which can then be linked to political outcomes at the municipality or department level.

Specifically, the project combines:

- Firm-level administrative data to track closures and structural changes.

- Employee-level data to observe labour market dynamics, including employment contracts, terminations, and earnings.

- Electoral data to measure shifts in vote shares for populist parties and participation rates across multiple election cycles.

The research aims to contribute to the understanding of:

- How economic dislocation affects trust in political institutions and support for anti-establishment parties.

- Whether the effects of economic shocks are persistent or diminish over time.

- The extent to which social protection mechanisms (e.g., unemployment benefits, retraining programs) mediate the impact on political behaviour.

By focusing on Italy, a country with both detailed administrative data and a history of political volatility, this study provides robust empirical evidence on the economic underpinnings of populism in advanced democracies.

Preliminary investigation

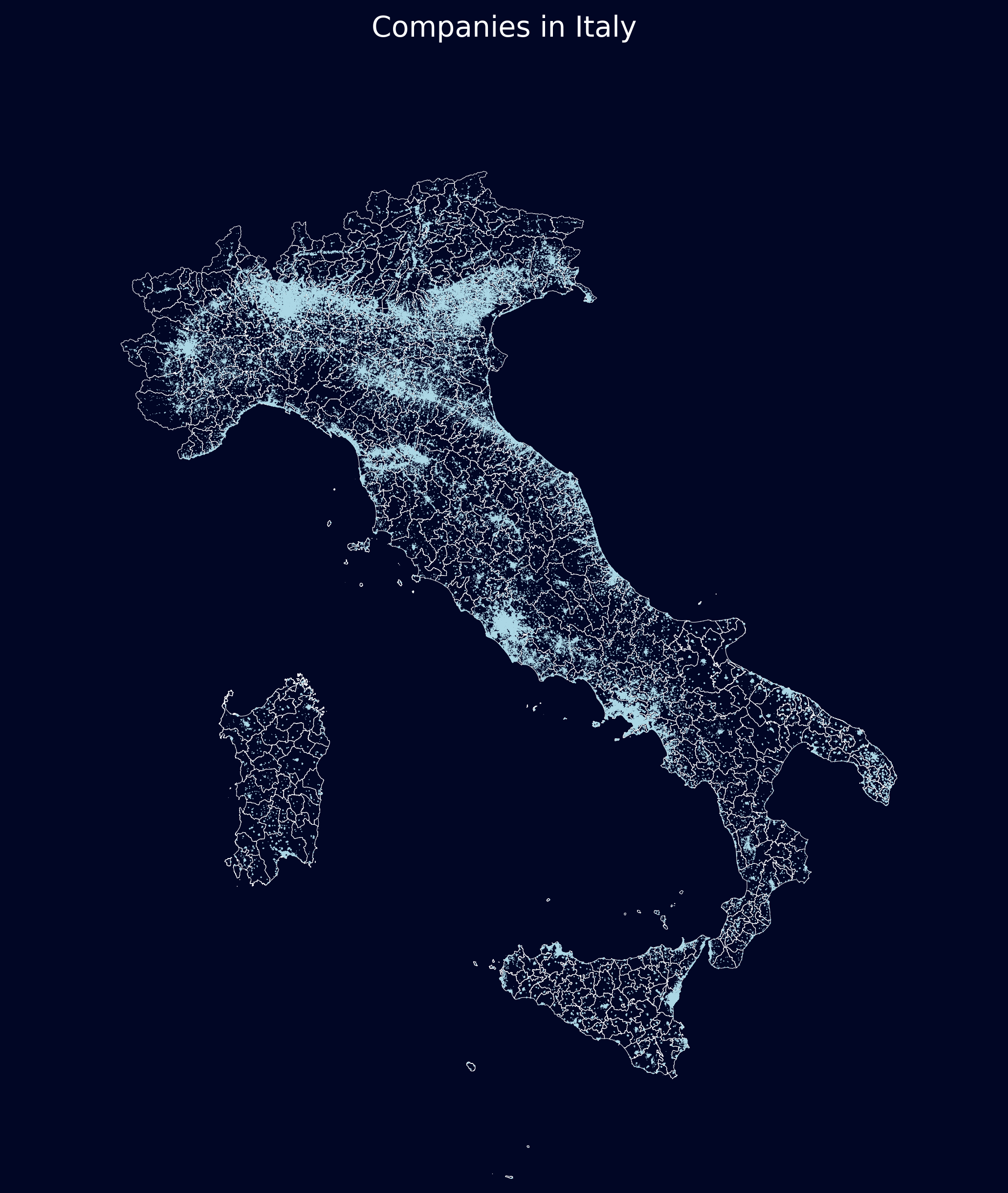

The first map shows the absolute distribution of companies across Italian municipalities. It highlights a dense concentration of firms in the northern and central regions, particularly around major economic hubs such as Milan, Turin, Venice (Veneto), Bologna, Florence (Tuscany), Rome, and Naples. These areas appear as bright clusters, reflecting the strong industrial and service-oriented economies that have historically driven business activity in these zones. In contrast, much of the south and the islands show a visibly sparser firm presence.

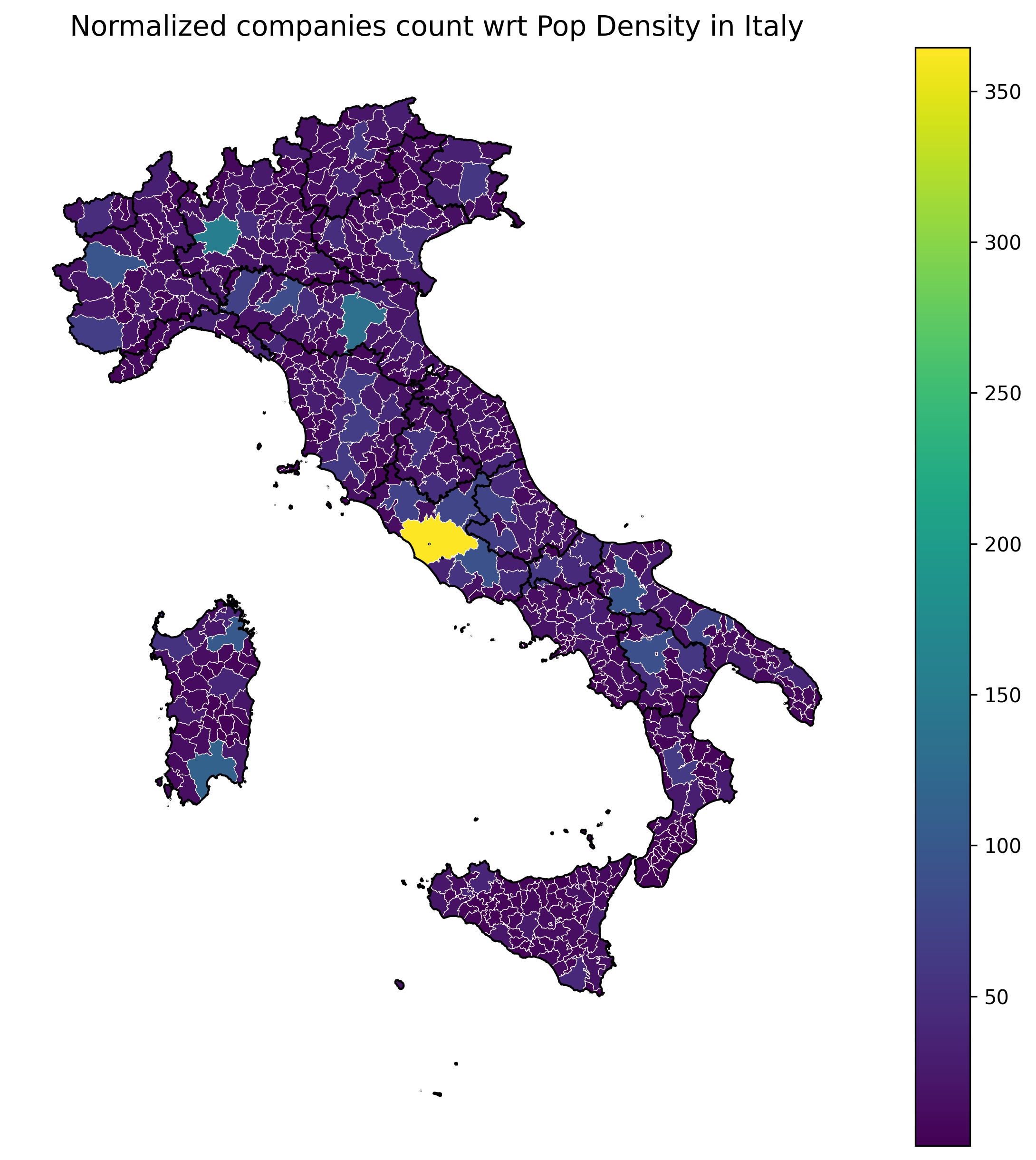

The second map normalizes the number of companies with respect to population density, revealing a different pattern. Here, some central and southern areas that were less prominent in absolute terms.

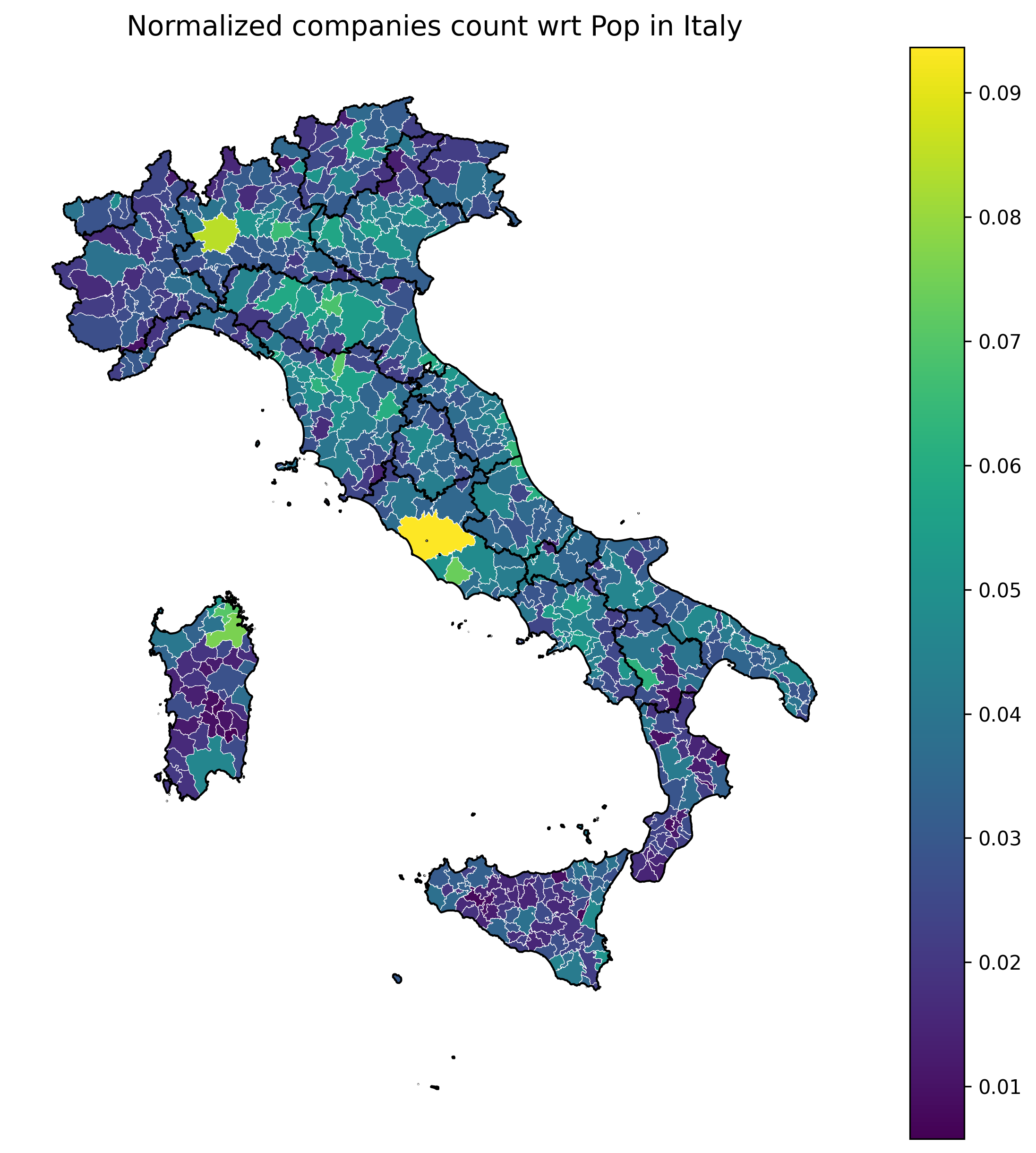

The third map adjusts the number of firms relative to total population, offering insight into entrepreneurial activity per capita. Meanwhile, much of the south—including regions like Calabria, Sicily, and parts of Campania—shows a notably lower concentration of firms per capita.